Services

We provide the best service in the branches we offer support:

Why choose us?

Security

We provide security in all businesses through our commitment and business strategy.

Trust

We are characterized by the transparency of our operations, always guaranteeing the best results.

Experience

45 years of experience leading the reinsurance market in Ecuador.

Support

We provide the best service in the branches that we offer support.

Frequently asked questions

We could grant facultative support in policies of General Third Party Liability, Products Third Party Liability, Environmental Pollution, Professional Third Party Liability and even Directors & Officers (D&O).

We do not currently underwrite these types of risks.

No. Theft and assault coverage must be offered in conjunction with Property Damage (Fire) policy.

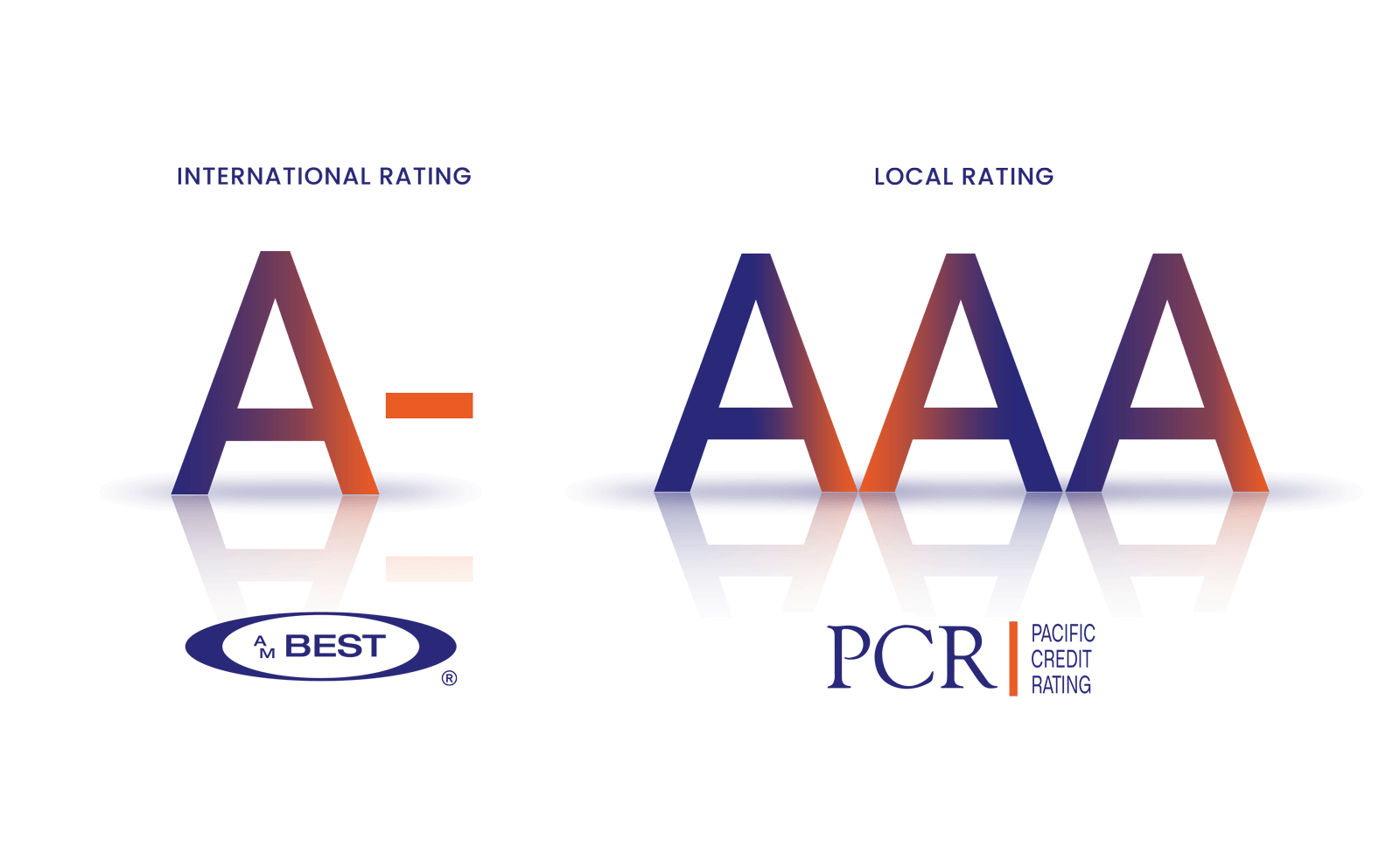

We are a highly prestigious company

who leads the reinsurance market in Ecuador

Financial Information

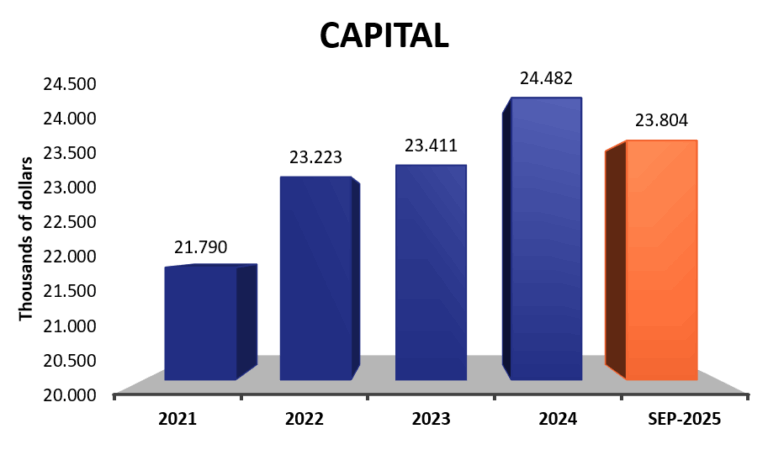

This graph shows the growth trend in equity over the last few years. For the 2024 period, equity was recorded at USD 24,482 million.

As of September 2025, the company’s financial strength is ratified, recording equity of USD 23,804 million.

Over 45 years of experience

Our experience in facultative businesses reflected in management indicators

0

0

0

0

Our Customers

Latest News

- Improved P&C insurance Q3‘25 underwriting results driven by US personal lines: AM Bestby Kassandra Jimenez-Sanchez on 14/01/2026 at 5:00 PM

Despite a turbulent 2025 start, marked by devastating California wildfires and multiple severe convective storms, the US property & casualty (P&C) […]

- OnRe & Rhodium Re in $150m partnership to expand ONyc underwriting distributionby Luke Gallin on 14/01/2026 at 4:39 PM

Global property and specialty reinsurer tokenized with ONyc, OnRe, has collaborated with Dubai-based managing general agent, Rhodium Re, to combine its capital […]

- Improved P&C insurance Q3‘25 underwriting results driven by US personal lines: AM Bestby Kassandra Jimenez-Sanchez on 14/01/2026 at 5:00 PM

Despite a turbulent 2025 start, marked by devastating California wildfires and multiple severe convective storms, the US property & casualty (P&C) insurance industry successfully recovered through the third quarter, driven largely by sustained momentum in personal lines, which managed to […]

- OnRe & Rhodium Re in $150m partnership to expand ONyc underwriting distributionby Luke Gallin on 14/01/2026 at 4:39 PM

Global property and specialty reinsurer tokenized with ONyc, OnRe, has collaborated with Dubai-based managing general agent, Rhodium Re, to combine its capital base with Rhodium’s underwriting presence, providing OnRe with direct access to underwriting expertise, established carrier […]

- Global Parametrics brings parametric protection to rural women farmers across Indiaby Kassandra Jimenez-Sanchez on 14/01/2026 at 4:20 PM

Global Parametrics, part of the CelsiusPro Group, has partnered with Frontier Markets, a rural social commerce platform, to launch a gender-smart parametric insurance solution across India. This product has been specifically designed to protect smallholder women farmers in four districts across […]

- Wattanaumphaipong joins Great American Insurance’s Singapore branchby Beth Musselwhite on 14/01/2026 at 4:00 PM

Great American Insurance Group, a property and casualty insurer, has announced the appointment of Nattakorn Wattanaumphaipong as Senior Director, Technical Underwriting for its Singapore Branch. In his new role, Wattanaumphaipong will oversee technical underwriting and portfolio management, […]

- PIC concludes £213m full buy-in for Siemens Healthineers UK benefit schemeby Kassandra Jimenez-Sanchez on 14/01/2026 at 3:40 PM

Specialist insurer PIC has completed a £213 million full buy-in with the Trustees of The Siemens Healthineers Benefits Scheme in the United Kingdom, securing the benefits of 703 pensioners and 967 deferred members and dependants. Siemens Healthineers supplies healthcare equipment and services, […]

- Allianz Re appoints Florian Steiner as Head of Capital and Legacy Solutionsby Beth Musselwhite on 14/01/2026 at 3:20 PM

Allianz Reinsurance, part of global insurer Allianz, has appointed Florian Steiner as Head of Capital and Legacy Solutions. In his new role, Steiner will oversee capital management and legacy and run-off activities for Allianz Re across Property & Casualty and Life & Health reinsurance. He […]

- Hiscox strengthens delegated authority and alternative risk solutions with new divisionby Beth Musselwhite on 14/01/2026 at 3:00 PM

Hiscox London Market is strengthening its position in the delegated authority and alternative risk sectors with the launch of a new division, Hiscox Portfolio Solutions. The division will consist of four distinct but complementary teams: Alternative Risk, Beta-Follow, Global MGA, and Structured […]

- Nick Line joins CFC as Chief Underwriting Officerby Kassandra Jimenez-Sanchez on 14/01/2026 at 2:30 PM

Specialist insurance provider, CFC has announced the appointment of Nick Line as Chief Underwriting Officer (CUO), taking over the role from Matt Taylor, who has served as interim CUO since February 2025. A former CUO at Markel International, Line brings a wealth of actuarial expertise and a track […]

- Cyber tops global business risks as AI surges: Allianz Risk Barometer 2026by Taylor Mixides on 14/01/2026 at 2:00 PM

Allianz Risk, part of the Allianz Group and a provider of insurance solutions and risk consulting for commercial and corporate clients, has published the Allianz Risk Barometer 2026, outlining the most significant risks expected to affect businesses worldwide over the coming year. The findings show […]

- FM expands capacity to strengthen support for data centres and digital infrastructureby Taylor Mixides on 14/01/2026 at 1:30 PM

FM, a commercial property insurer, has announced a major increase in capacity to support its global FM Intellium clients and the data and power generation sectors, providing unmatched coverage limits and risk management expertise. Building on nearly 200 years of engineering experience and […]

We innovate and provide a timely, safe and reliable service

Generating confidence to our customers