Services

We provide the best service in the branches we offer support:

Why choose us?

Security

We provide security in all businesses through our commitment and business strategy.

Trust

We are characterized by the transparency of our operations, always guaranteeing the best results.

Experience

45 years of experience leading the reinsurance market in Ecuador.

Support

We provide the best service in the branches that we offer support.

Frequently asked questions

We could grant facultative support in policies of General Third Party Liability, Products Third Party Liability, Environmental Pollution, Professional Third Party Liability and even Directors & Officers (D&O).

We do not currently underwrite these types of risks.

No. Theft and assault coverage must be offered in conjunction with Property Damage (Fire) policy.

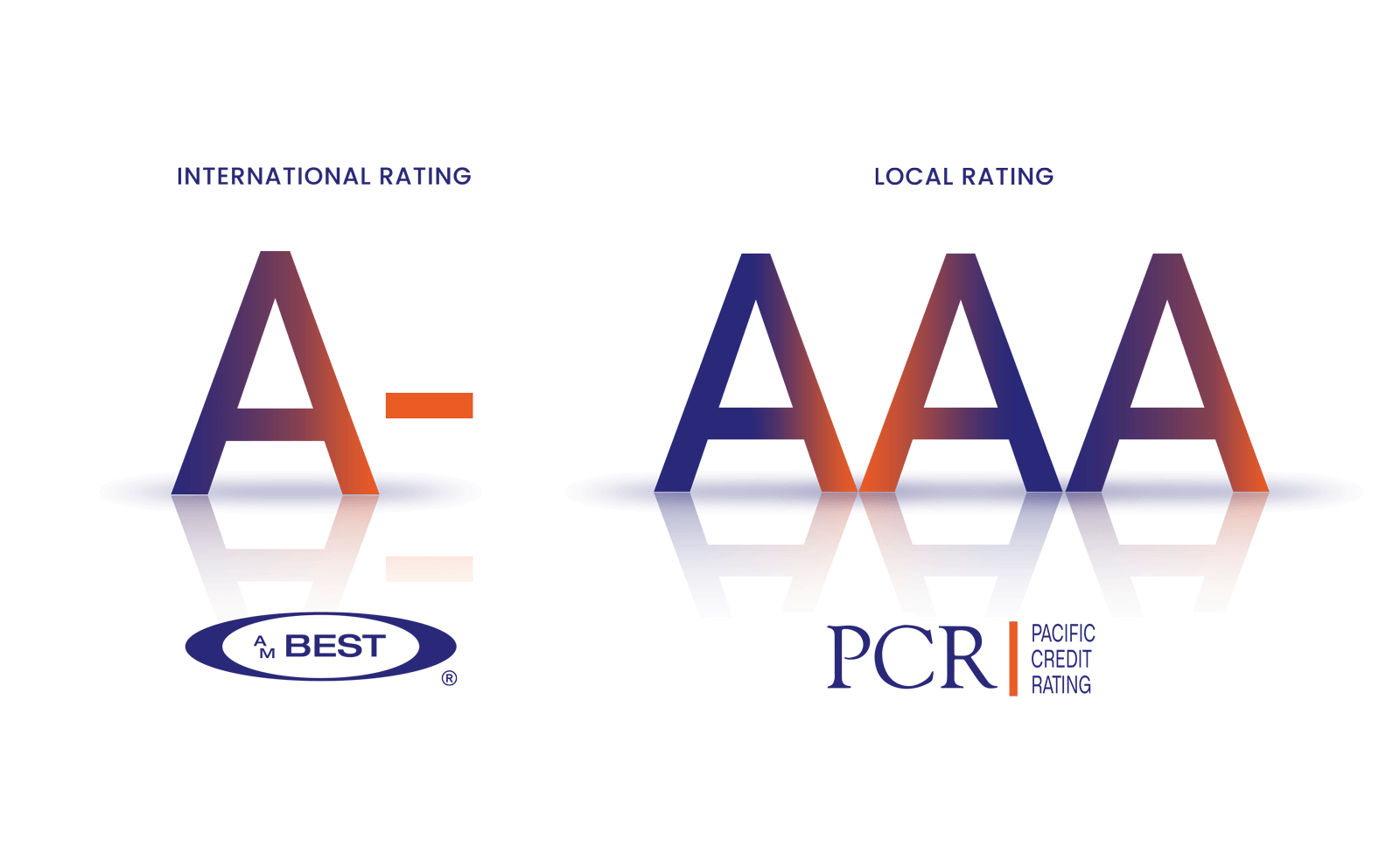

We are a highly prestigious company

who leads the reinsurance market in Ecuador

Financial Information

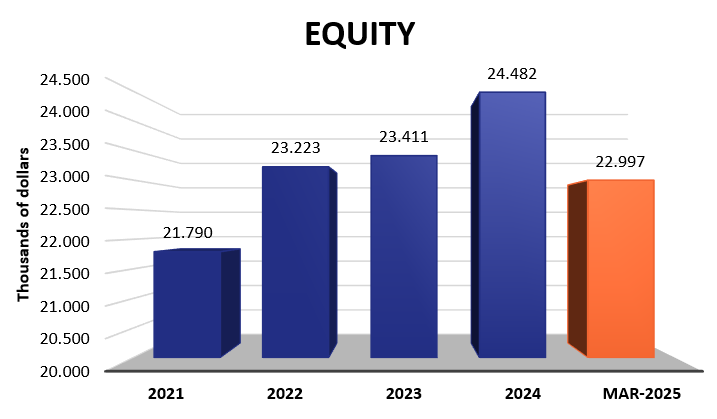

This graph shows the growth trend in equity over the last few years. For the 2024 period, equity was recorded at USD 24,482 million.

As of march 2025, the company’s financial strength is ratified, recording equity of USD 22,997 million.

Over 45 years of experience

Our experience in facultative businesses reflected in management indicators

0

0

0

0

Our Customers

Latest News

- Athora to acquire Pension Insurance Corporation for £5.7bnby Luke Gallin on 03/07/2025 at 4:16 PM

Pan-European savings and retirement services group, Athora, has reached an agreement to acquire Pension Insurance Corporation Group Limited, the parent of […]

- Jacques Bonneau appointed Non-Executive Chair of Ki Financialby Saumya Jain on 03/07/2025 at 3:30 PM

Ki, the fully digital and algorithmically-driven Lloyd’s syndicate, has appointed Jacques Bonneau as Non-Executive Chair for Ki Financial Limited, effective […]

- Athora to acquire Pension Insurance Corporation for £5.7bnby Luke Gallin on 03/07/2025 at 4:16 PM

Pan-European savings and retirement services group, Athora, has reached an agreement to acquire Pension Insurance Corporation Group Limited, the parent of Pension Insurance Corporation plc, a specialist insurer of UK defined benefit pension schemes, for approximately £5.7 billion. Athora has €76 […]

- Jacques Bonneau appointed Non-Executive Chair of Ki Financialby Saumya Jain on 03/07/2025 at 3:30 PM

Ki, the fully digital and algorithmically-driven Lloyd’s syndicate, has appointed Jacques Bonneau as Non-Executive Chair for Ki Financial Limited, effective July 1st, 2025. Bonneau, who retired in March 2024, previously served as President & Chief Executive Officer (CEO) of Bermuda-domiciled […]

- IDB expands disaster risk coverage by $2bn, introduces new instrumentsby Beth Musselwhite on 03/07/2025 at 3:00 PM

The Inter-American Development Bank (IDB) has expanded disaster risk coverage by an additional $2 billion and introduced new instruments for both sovereign and private clients. The $2 billion expansion includes $1 billion for its Contingent Credit Facility for Natural Disasters and another $1 […]

- AXA XL appoints Victoria Killingsworth as Senior Underwriter, E&Sby Beth Musselwhite on 03/07/2025 at 2:30 PM

AXA XL, the property and casualty (P&C) and specialty risk division of global insurer AXA, has announced the appointment of Victoria Killingsworth as Senior Underwriter for Excess & Surplus (E&S) lines. In her new role, Killingsworth will underwrite E&S property risks across a range […]

- Asset manager Janus Henderson partners with life insurer Guardianby Kassandra Jimenez-Sanchez on 03/07/2025 at 2:00 PM

The Guardian Life Insurance Company of America, one of America’s largest life insurers and providers of employee benefits, has partnered with Janus Henderson Group plc, a global asset manager. Under the terms of this agreement, Janus Henderson will become Guardian’s investment grade public […]

- Zurich expands cyber capabilities with acquisition of BOXX Insuranceby Kassandra Jimenez-Sanchez on 03/07/2025 at 1:30 PM

Global insurer Zurich Insurance Group has entered into an agreement to acquire BOXX Insurance Inc., a Toronto-based cyber insurance and risk management insurtech, which will be integrated into Zurich Global Ventures (ZGV). This acquisition is set to boost Zurich’s cyber protection capabilities, […]

- Q2 2025 cat bond issuance hits record $10.5bn: Artemisby Luke Gallin on 03/07/2025 at 1:00 PM

The second quarter of 2025 was another record period for the catastrophe bond market, with issuance of $10.5 billion from 38 transactions comprised of 58 tranches of notes, ensuring that new annual records have been set for 144A property cat bond and total 144A cat bond and related ILS issuance, in […]

- Fire Safety Reinsurance Facility expands coverage limit to £70mby Kassandra Jimenez-Sanchez on 03/07/2025 at 12:30 PM

The insurance industry’s Fire Safety Reinsurance Facility, an initiative aimed at providing insurance coverage for multi occupancy buildings with fire safety issues, has increased its coverage limit from £50 million to £70 million, the Association of British Insurers (ABI) has revealed. This […]

- It’s time to automate the ceded reinsurance process, says DXC Technology’s James Mahonby Taylor Mixides on 03/07/2025 at 12:00 PM

In a recent interview with Reinsurance News, James Mahon, Reinsurance Pre-Sales Lead at DXC Technology, highlighted a persistent issue facing the re/insurance industry: the continued reliance on manual processes for managing ceded reinsurance. DXC Technology provides IT services and solutions to […]

- Liberty GTS appoints Hilary Weiss as Head of Americasby Kassandra Jimenez-Sanchez on 03/07/2025 at 11:30 AM

Liberty Global Transaction Solutions (GTS), part of Liberty Mutual Insurance, has announced the promotion of Hilary Weiss to Head of Americas, effective immediately. Weiss has been part of Liberty Mutual since 2018, when she joined the company as Associate Vice President, Americas M&A. She then […]

We innovate and provide a timely, safe and reliable service

Generating confidence to our customers